Standard Deduction Single Over 65 Tax Year 2025. 2025 standard deduction over 65. Standard deductions for taxpayers over 65.

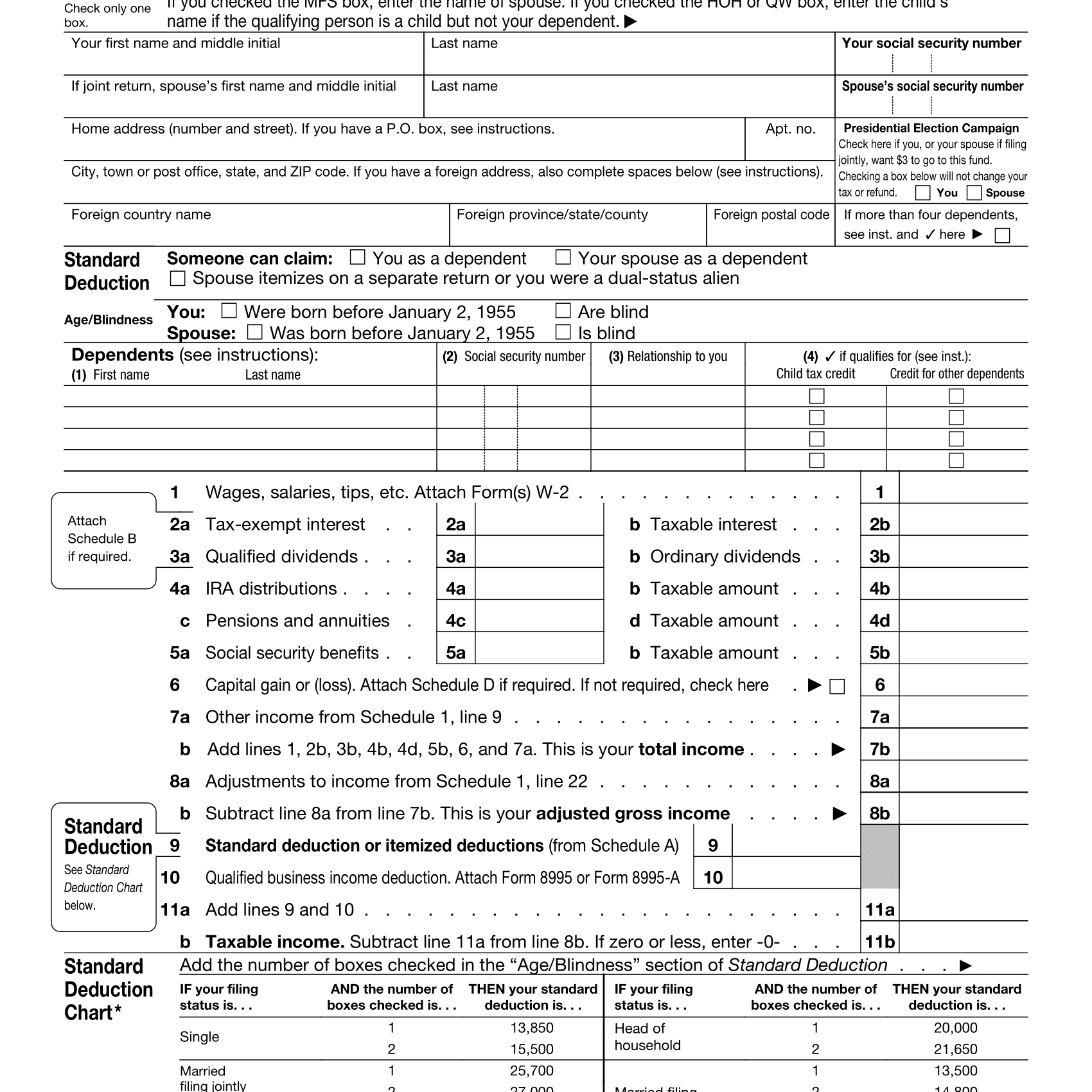

The standard deduction for tax year 2025 is $14,600 for singles, $29,200 for joint filers and $21,900 for heads of household. If you are at least 65 years old or blind, you can claim an additional 2025 standard deduction of $1,850 (also $1,850 if using the single or head of household filing status).

Tax Brackets 2025 Irs Single Elana Harmony, Taxpayers 65 and older and those who are blind can claim an additional standard deduction. Here are the standard deduction amounts set by the irs:

2025 Tax Brackets Chart Mela Stormi, Each joint filer 65 and over can increase the standard deduction by $1,550 apiece, for a total of $3,100 if. The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

2025 Tax Brackets Mfj Limits Brook Collete, Standard deduction 2025 over 65. The 2025 standard deduction for tax returns filed in 2025 is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household.

Irs 2025 Standard Deductions And Tax Brackets Loni Marcela, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or. The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or.

Standard Deduction 2025 Age 65 Standard Deduction 2025, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or. You're considered to be 65 on the day before your 65th.

Should You Take The Standard Deduction on Your 2025/2025 Taxes?, Seniors over age 65 have access to an additional $1,850 standard deduction on top of their base rate, which helps reduce taxable income and gives them. If you are both, you get double the.

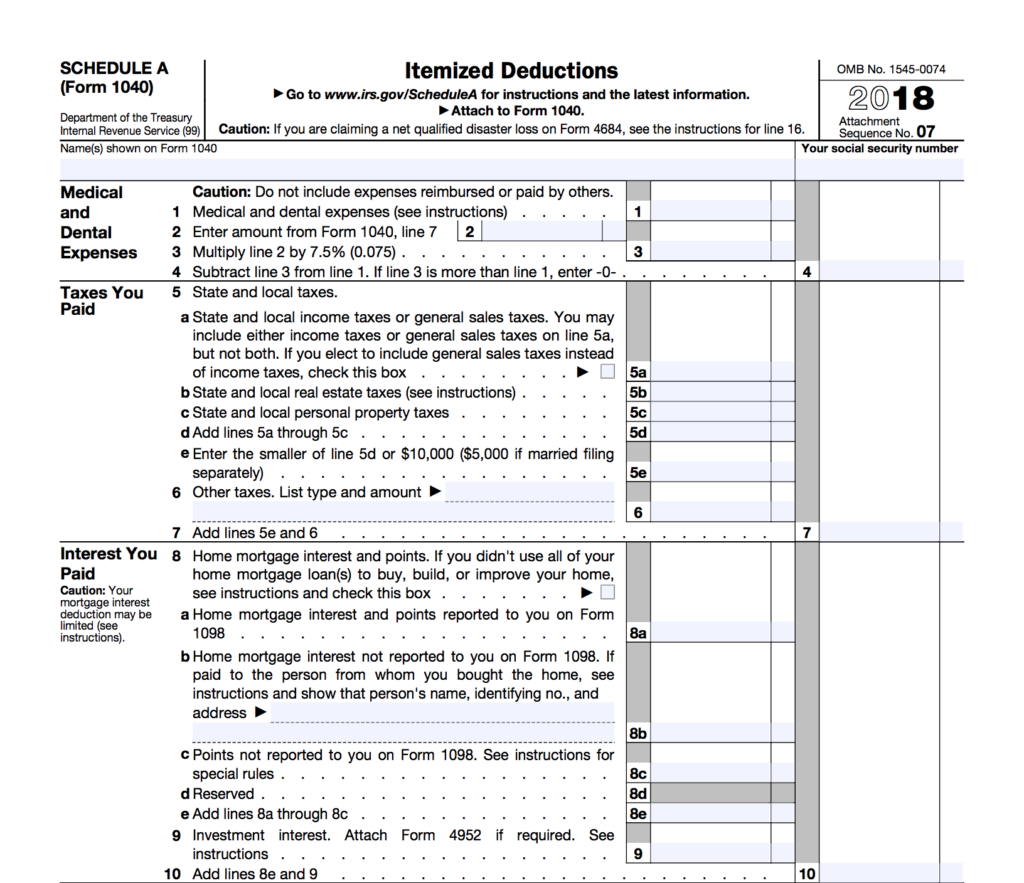

Standard Deduction or Itemized Deductions Tax Defense Network, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or. There’s even more good news for older taxpayers.

2025 Standard Deduction For Over 65 Standard Deduction 2025, $14,600 for married couples filing. The tax brackets, standard deduction, and the capital gains tax cutoff point for single and married filing jointly filing statuses will go up in 2025.

What to Expect When Filing Your Taxes This Year, You are considered age 65 on the day before. The standard deduction rose in 2025.

.jpg?width=8333&name=tax graphic_2020 (1).jpg)

Irs Standard Deduction 2019 Over 65 Standard Deduction 2025, The standard deduction will increase by $750 for single filers and by $1,500 for joint filers (table 2). How much is the additional standard deduction?